Occidental Petroleum Corporation will no longer be selling their oil and gas assets in Algeria.

Occidental Petroleum Corporation will no longer be selling their oil and gas assets in Algeria.

This was made known in a conference call with analysts by the Chief Executive officer of the Houston-based oil producer, Vicki Hollub.

Earlier in May, the firm’s proposed sale of its Algerian assets to Total SA was blocked by Algeria. This disrupted the projections of Occidental who was hoping to use the proceeds from the sale to pay off its compiled debt after the $37 billion purchase of Anadarko petroleum Corporation last year.

The COVID-19 pandemic which has severely dealt a blow on the oil market leading to low demands and a cut in global supply has further harmed the financial status of the company. In May, it was forced to cut its quarterly dividend to the lowest level in decades. It reported a $6.6 billion writedown in the second-quarter of 2020 which is equivalent to over 40% of the company’s market value.

The C.E.O said, “It’s not that we gave up on selling Algeria,” Hollub said on the call. “We believe that those assets there are such high quality, they’re going to be very competitive with our domestic assets. We want to be in Algeria.”

The asset disposal programmes in Algeria and Ghana was expected to raise about $5 billion to enable Occidental to settle its debt which is due for repayment in 2021.

French Energy giant, Total SA also opted out of its deal with Occidental Petroleum to purchase Anadarko assets in Ghana. It after a collapse in a proposal to buy Algerian assets by the company earlier the same month. The company cited low oil prices as one of its major reasons for backing out of the deal.

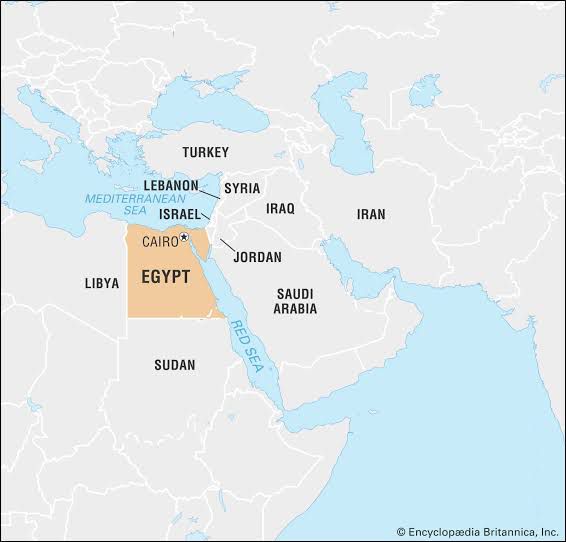

According to sources, the company is also in talks over the sale of its energy assets in Africa and the middle east to Indonesia’s state-owned PT Pertamina.