Rallying energy commodity prices are expected to drive up primary energy expenditures globally to a record 13% of global gross domestic product (GDP), comparable to the energy cost levels during the 1979-80 energy crisis, according to a new report released on Wednesday, March 16th, 2022 by Thunder Said Energy, a research consultancy for energy technologies.

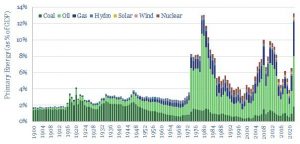

According to the firm, the predicted record 13% energy expenditure would be three times the average of 4% between 1900 and 2020 and 1.3 times 2018 levels. Primary energy expenditures have averaged 4% of global GDP since the beginning of the twentieth century, rising to 8% after the first oil shock, 13% after the second oil shock, 10% in 2008, and 8-10% in 2013-2015, when prices were high.

Thunder Said Energy said that the forecast of a record energy spending as a percentage of global GDP assumes coal prices of $250-$300 per tonne, crude oil prices of $125-$150 per barrel, and global natural gas prices of $40-45/mcf.

Analyst & CEO at Thunder Said Energy, Rob West, said: “So, this is not an ‘oil shock’ or a ‘gas shock’ but an ‘everything shock'”

“Curtailing demand is the only short-term option to alleviate shortages. There are no good options here, only ‘less bad’ ones.”

Crude oil, natural gas, and coal prices had all climbed before the war between Russia and Ukraine, but the war premium propelled coal and natural gas prices to all-time highs early this month, while crude oil prices hit a 2008 high of over $130 per barrel last week.

Thunder Said Energy, like many other experts and industry leaders, is concerned about recent underinvestment in conventional energy, especially given the fact that fossil fuels still account for roughly 83% of global energy demand.