The Japanese state, in partnerships with the private sector, has announced it will invest up to $14 billion (1,500 billion yen) in the production of Liquefied Natural Gas (LNG) in Mozambique.

The funding of the project is said to be coming from several Japanese banks, the public and private sector, as well as the African Development Bank (AfDB). Reports indicate that these funds will be used in the financing the exploitation of a natural gas field in the country, to produce about 12 million tonnes of LNG annually from 2024.

Japan is the world’s largest importer of LNG and this is a step in the right direction to secure its energy supplies and prepare for unexpected circumstances like the coronavirus pandemic that broke down the country’s channel of distribution in the energy sector.

The significant named financing institutes are the Japan Bank for International Cooperation, a public company which contributes up to 43 billion in loans, the African Development Bank and four major Japanese private sector banks (MUFG Bank, Mizuho Bank, Sumitomo Mitsui Banking and Sumitomo Mitsui Trust Bank).

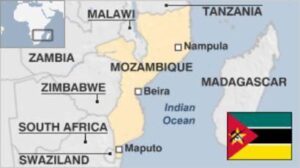

The Japanese investment is a huge boost for the Southern Africa country and it will make it one of the largest recipients of foreign investment in Africa. Mozambique has over the years constantly strategise and position itself as a major player of LNG in Africa and the world.

French giant, Total, is actively involved in the Energy scene of Mozambique. Total is developing a $20 billion worth of project to produce 13 million tonnes of fuel per year. The American oil company, Exxon Mobil is also actively involved in the scene as it is also developing the Rovuma project which is intended to produce about 15 million tonnes of LNG.

Total also heads the Rovuma Offshore Area One Consortium in Mozambique. Its partners are Mitsui of Japan, PTTEP of Thailand, Mozambique National Hydrocarbon company and three Indian companies – ONGC Videsh, Beas and Bharat Petro Resources.