Natural resources investment company, ADM Energy, has announced it has reached a conditional agreement to invest in the Barracuda oil field in OML 141, offshore Nigeria, through an acquisition of a 51% interest in K.O.N.H UK, which holds an indirect interest in a Risk Sharing Agreement (RSA) for the Field.

Consideration for the Investment may reach $1.3 million, of which $0.25 million is to be settled in cash on completion and the balance is to be settled in equity at the higher of 7p and the then prevailing share price, on completion and satisfaction of certain project milestones.

The acquisition is expected to be completed by the second quarter of 2021. KONH, through its subsidiary, Noble Hill – Network Limited (NHNL), holds a 70% indirect interest in the rights, benefits and obligations under the RSA relating to the Barracuda area of OML 141.

The Chief Executive Officer of ADM, Osamede Okhomina, said: “This is a compelling investment opportunity that provides ADM with the potential to access near-term production upside at minimal risk. The Barracuda Field in OML 141 fits our strategy to target near-term production assets in proven oil and gas jurisdictions and will establish ADM Energy as a multi-asset player in Nigeria. We will bring technical and financial support to the consortium to develop the asset and take it into production in the second half of this year. We have structured the deal to receive an accelerated cash entitlement once the field is in production, with the intention that the cost of the first well will be supported by our financing partner, Dubai Bridge Investments.”

The Chief Executive Officer of ADM, Osamede Okhomina, said: “This is a compelling investment opportunity that provides ADM with the potential to access near-term production upside at minimal risk. The Barracuda Field in OML 141 fits our strategy to target near-term production assets in proven oil and gas jurisdictions and will establish ADM Energy as a multi-asset player in Nigeria. We will bring technical and financial support to the consortium to develop the asset and take it into production in the second half of this year. We have structured the deal to receive an accelerated cash entitlement once the field is in production, with the intention that the cost of the first well will be supported by our financing partner, Dubai Bridge Investments.”

The Chairman of Dubai Bride Investments, HE Zubair Al Zubair, said: “We partnered with ADM at the end of last year because their strategy aligned with our own of seeking out investment opportunities in the energy sector in Africa. The Barracuda Field, an attractive near-term production asset with significant potential upside, is the type of excellent opportunity we envisioned when we first decided to collaborate with ADM. Our planned financial backing combined with ADM’s extensive contacts and breadth of experience of the region and the oil and gas industry forms a formidable partnership and we look forward to building a long-term relationship.”

THE BARRACUDA FIELD

The Barracuda field sits in OML 141, an oil mining licence area covering 1,295 km2 in the swamp/shallow waters of the Niger Delta in Nigeria. Four existing wells drilled in 1967 (three wells by Tenneco) and 2007 (one well by CNOOC) penetrated oil-bearing high-quality C3 and D-1B sands typical of the stacked delta top and prodelta reservoirs in faulted listric settings common in this area. The plan is for a fifth well to be drilled (Barracuda-5) to carry out a flow test in Q4 2021 which, if successful, will be brought onstream.

ABOUT ADM

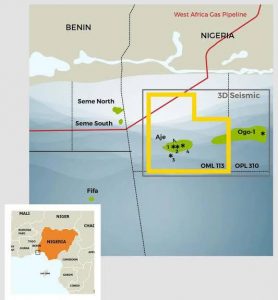

ADM Energy is targeting investment opportunities across West Africa in the oil and gas sector with attractive risk reward profiles such as proven nature of reserves, level of historic investment, established infrastructure, route to early cash flow. ADM Energy also holds a 9.2% profit interest in the Aje Field, part of OML 113, which covers an area of 835km² offshore Nigeria.