Angola is reportedly renegotiating with its key lenders to reschedule its debt payments, after an interruption of about three months due to the COVID-19 pandemic and the global drop in oil prices.

Angola is reportedly renegotiating with its key lenders to reschedule its debt payments, after an interruption of about three months due to the COVID-19 pandemic and the global drop in oil prices.

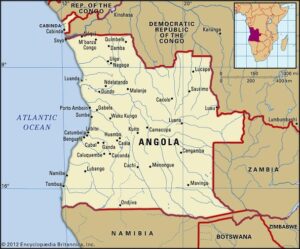

Like most oil-producing countries on the African continent, fuel accounts for almost 90% of the APPO member’s export. This means that the south-western country and the continent’s second-biggest crude producer depends on revenues made from the sale of crude to fund its yearly budget and grow its economy.

This renegotiation comes after a prolonged recession caused by the drop in oil prices. President João Manuel Gonçalves Lourenço of Angola made this known in a state broadcast via the state-controlled Radio Nacional de Angola (RNA) on Friday. He gave no details about the specific loans and only mentioned that negotiations on repayment were ongoing.

The President mentioned that the measures being put in place to fight the pandemic and drastic drop in oil prices may cause an economic contraction for the fifth consecutive time this year. He was quoted saying, “The government started the renegotiation of our sovereign and commercial debt with the main credit institutions of Angola. The results will be known in due course.”

Also, concerns are being raised about the sustainability of the nation’s finances, as the President’s broadcast talks about plans to review some of the current debts which it is paying, as well as delaying the payment of accumulated arrears. According to a Lisbon-based analyst at Eaglestone Advisory SA, Tiago Dionisio, Angola has been bartering its oil for payment of its debt to China.

According to a forecast from the International Monetary Fund, Angola’s debt is set to rise more than 22 percentage points to 132% of the gross domestic product in 2020.

Simon Quijano Evans, the chief economist at Gemcorp Capital, owners of Sub-Saharan African debt said, “The most important supportive factor for Angola is the recovery in oil prices. Any relief on the bilateral debt front would provide extra breathing space and clear the way for new IMF funding.”

Angola joins other African countries in sourcing for multilateral lenders and looking for ways to agree on debt relief from their creditors, as the coronavirus pandemic had caused a low demand for oil. As a result of the low prices, OPEC member countries and allies have had to cut their production to help stabilize and aid the recovery of the global oil market. Unless there is a global recovery in oil prices soon, Angola may have to keep sourcing for funding from lenders, or like Zambia, consider restructuring its borrowing.