According to reports, the overseas investment arm of the state-owned firm, India’s Oil and Natural Gas Corp, ONGC Videsh Limited (OVL), China National Petroleum Corporation (CNPC) and Malaysia’s Petronas have withdrawn from the block they operate in Sudan.

ONGC exited Sudan due to non-payment of oil lifted from the fields by Sudan. OVL had a 25% stake in block 2A&4 while its partners, CNPC had 40%, Petronet had 30% and Sudapet had 5% interest. Sudan is reportedly owing to the partners since 2011, a debt that amounts to $430.69 million.

ONGC exited Sudan due to non-payment of oil lifted from the fields by Sudan. OVL had a 25% stake in block 2A&4 while its partners, CNPC had 40%, Petronet had 30% and Sudapet had 5% interest. Sudan is reportedly owing to the partners since 2011, a debt that amounts to $430.69 million.

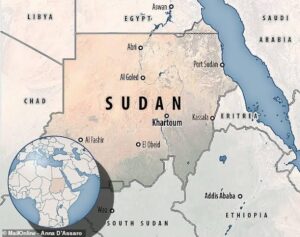

Sudan is said to owe OVL about $99 million for the construction of the 741 kilometres long pipeline that the company built from Khartoum to Port Sudan. The cost of the project and rental of $254 million was to be paid by Sudan in 18 half-yearly equated instalments of $14.135 million each from December 30, 2005. The company reportedly only got 11 instalments which amount to $155.48 million till December 2010, and the balance of 7 instalments amounting to $98.94 million is yet to be paid.

According to the revealing source, after failed several attempts at using diplomatic channels to receive all the outstanding payments, OVL has initiated separate legal proceedings against the Sudanese government to recover the outstanding dues and has terminated the Exploration and Production Sharing Agreement (EPSA).

OVL has been present in Sudan since 2003 when it acquired a 25% interest in the Greater Nile Oil Project. The GNOP consisted of upstream assets of on-land Blocks 1,2 and 4 spread over 49,500 square kilometres in the Muglad Basin, located about 780 kilometres South-West of Khartoum, Sudan.

Upon the secession of South Sudan from Sudan in July 2011, the contract areas of Blocks 1, 2 and 4 were split with a major share of production and reserves now situated in South Sudan. After the secession, the government of Sudan’s share of total production from Sudan was not sufficient to meet the requirements of local refineries so foreign firms were asked to sell their share of crude oil to it.

Sudan also denied ONGC and partners an extension of licence to operate block 2B after the initial contract expired in November 2016.